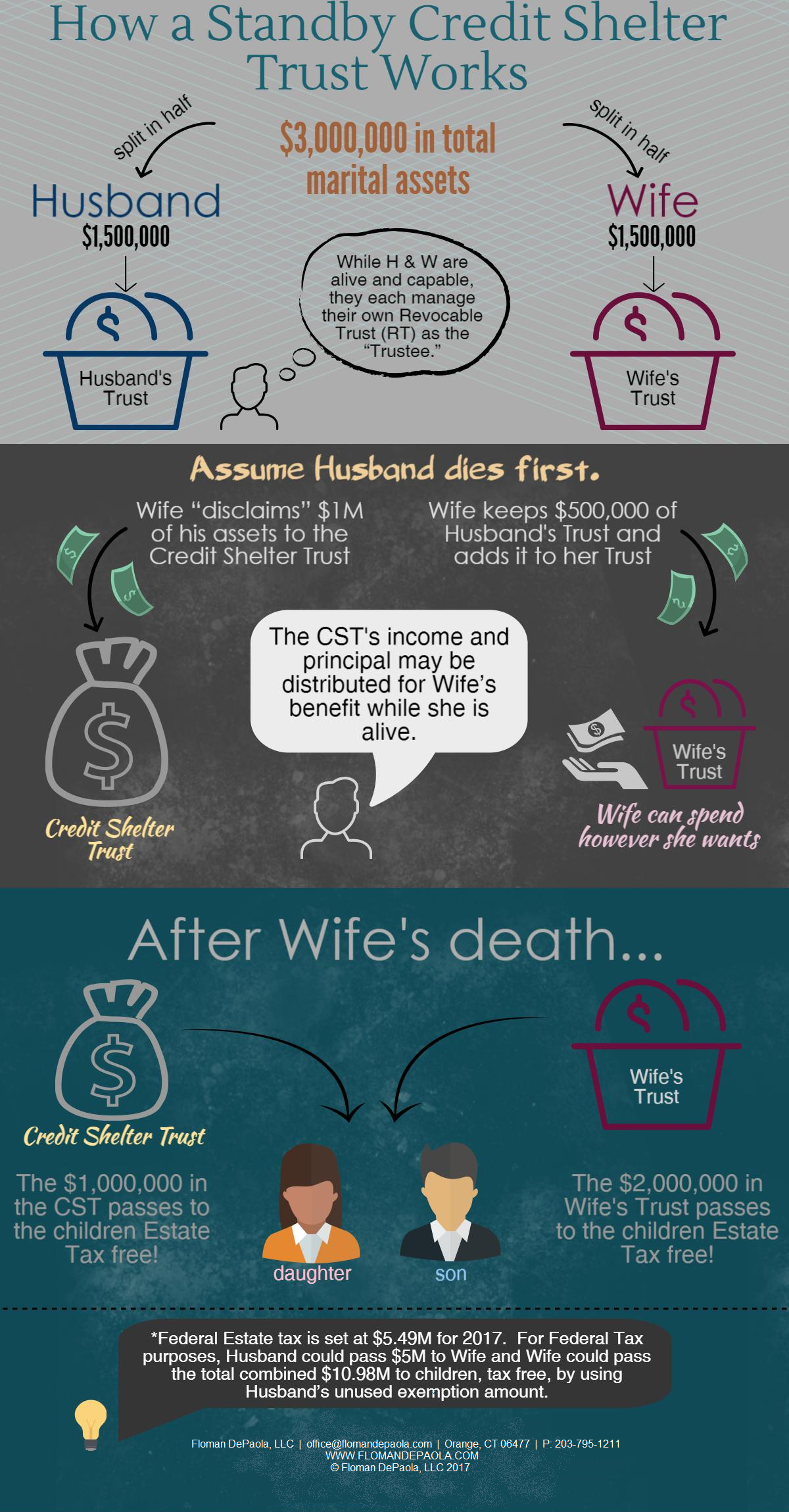

Many married couples are concerned about Connecticut Estate Tax planning and therefore are interested in a Connecticut Credit Shelter Trust. A commonly used tool used in Connecticut Estate Tax planning that aims to reduce or eliminate the Connecticut Estate Tax is the Standby Credit Shelter Trust. The chart, below, demonstrates how a Connecticut Standby Credit Shelter Trust may help married couples to achieve their Connecticut estate tax planning goals.

Summary of Connecticut Estate Taxes:

Before trying to achieve Connecticut Estate Tax Planning goals by using a Connecticut Credit Shelter Trust it is important to know the basics of both federal and Connecticut estate taxes. In sum, you may pass an unlimited amount of assets to your United States Citizen spouse without paying any Connecticut estate taxes. Assets that pass to non-spouse beneficiaries may be taxable depending on the date of death value of the assets. The federal estate-tax exclusion for 2017 is $5,490,000.00 (total) and the Connecticut estate-tax exclusion is $2,000,000.00 (total).

How is a STandby Credit Shelter Trust Created?

Standby Credit Shelter Trusts can be created through your Revocable Trust a/k/a Living Trust. The Revocable Trust states that when the first spouse dies all of the first spouse’s assets should be given to the surviving spouse, unless the surviving spouse elects to “disclaim” those assets to the Standby Credit Shelter Trust. The Credit Shelter Trust is “standby,” meaning, it is available for the surviving spouse to elect to use, if at all. If the surviving spouse doesn’t want to use the Credit Shelter Trust at that time, he/she do not have to. This gives the surviving spouse the opportunity to assess his/her financial situation at that time.

WHO Is the beneficiary of the STANDBY Credit Shelter Trust?

The surviving spouse is the sole beneficiary of the Standby Credit Shelter Trust during his/her lifetime. Although the assets were disclaimed by the surviving spouse, the surviving spouse may still have some use of these assets. However, the surviving spouse’s use of these assets is dependent upon the cooperation of an Independent Trustee.

Who is the Independent Trustee?

A trusted family member, friend, professional advisor, or a bank/institution would be the Independent Trustee of the CST.

Why would a surviving spouse not want the assets?

If he/she has enough assets in his/her name to meet his/her living expenses and wants to pass assets to other beneficiaries (i.e. children and/or grandchildren) without incurring higher estate taxes. The Standby Credit Shelter Trust is designed to “shelter” assets from the estate tax that would otherwise be payable when the second spouse dies if all of the assets were in the surviving spouse’s name.

What if the surviving spouse doesn’t like or disagrees with the Independent Trustee in the future?

The surviving spouse may replace the Independent Trustee. However, he/she cannot replace an independent trustee more frequently than every two (2) years.

What happens after the death of the second spouse?

After the surviving second spouse dies, any assets left in the Standby Credit Shelter Trust are distributed to beneficiaries (i.e. children, family members, friends).